REVERSE SPLIT

Welcome to the Knowledge Centre to read more about the reverse split of shares. You will find here both theoretical information supported with simple examples, all stages of the entire process, as well as a complete set of information on the reverse split of shares of LUG S.A.

The reverse split of shares is not a new procedure, but despite many cases of re-split in Poland and in the world, it is difficult to find comprehensive information in this regard. We would like to provide all the necessary data in our Knowledge Centre to our Shareholders and Investors interested in the operation of LUG S.A. We are also open to your suggestions and comments.

Welcome!

Theory in a nutshell:

-

Basic information

The reverse split of shares means the re-split of shares.

This procedure provides for an increase in the nominal value of shares with the reduction of their total number, while the share capital remains unchanged.

Example 1:

The Company X issued a total of 5,000,000 shares with nominal value of PLN 0.25 each. As a result of the reverse split of shares in the ratio of 5:1, the number of shares of the Company fell to a level of 1,000,000 shares and the nominal value of each share increased to PLN 1.25.

As a result of the reverse split of shares, the shareholder has fewer shares, but with a higher value of each. Once the reverse split, or reduction of the number of shares, is completed, the share price (market price for 1 share) increases in proportion to a fixed exchange ratio. This is because after the reverse split, the fewer number of shares reflect the market capitalization, which was not directly affected by the re-split procedure.

The reverse split of shares neither affects the shareholders' rights resulting from the title to shares of the company, nor does it change the shareholding structure, which means that the percentage of individual shareholders in the share capital and the share of votes at the General Meeting do not change.

Example 2:

Before the reverse split:

The Shareholder Z of the Company Y holds 100,000 shares. The Company Y issued a total of 2,000,000 ordinary bearer shares of all series. This means that the Shareholder has a 5% stake in the share capital of the Company Y and the same number of votes at the General Meeting.

After the reverse split (ratio 10:1)

The Shareholder Z of the Company Y holds 10.000 shares. The total number of ordinary bearer shares of all series of the Company Y after the reverse split is 200,000 shares. This means that the Shareholder Z invariably has a 5% stake in the share capital of the Company Y and the same number of votes at the General Meeting.

Among the benefits in favour of the reverse split is to reduce the volatility of the share price and minimize the risk for the company to become a penny company.

The added value of the whole process is also the improved image of the company by increasing the market value of its securities, and thus increasing their attractiveness, especially among institutional investors.

-

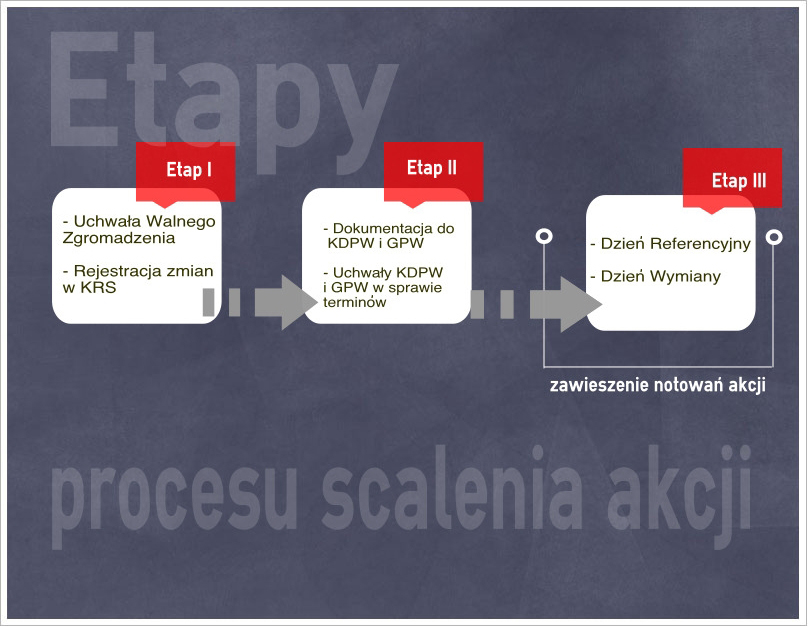

Stages of the reverse split process

Case study - reverses stock split of LUG S.A.

-

Reverse split details

- Ratio of the reverse split of shares of LUG is 25:1

- As a result of the reverse split, the nominal value of shares of LUG with a value of PLN 0.01 (one grosz) will be increased to PLN 0.25 (twenty five grosz).

- The reverse split of shares will be proportionate to the reduction in the total number of shares of all series A, B, C, where the total number of 179,964,250 shares will be reduced to the number of 7,198,570, i.e. through the consolidation of each twenty-five shares of the Company with the current nominal value of one grosz into one share of the Company with the new nominal value of twenty-five grosz.

- The reverse split of shares will be carried out while maintaining the same share capital in the amount of PLN 1,799,642.50.

-

Legal basis

The procedure of the reverse split of LUG shares will be carried out pursuant to Resolution No. 4 of the Extraordinary General Meeting of LUG S.A., held on 28 September 2012 at the registered office of LUG S.A. in Zielona Góra.

To read the contents of the Resolution, click on the link below:

Notarial Deed - Extraordinary General Meeting of LUG S.A. 28.09.2012 (PL)

-

Reverse split shortages

The reverse split procedure may lead to shortages.

Shortages, or the so-called minority stakes, exist when the number of shares held by the shareholder, in accordance with the agreed exchange ratio, does not form one share of the new nominal value after the reverse split. In other words, the reverse split of LUG shares will create the shortages when the number of shares held by the shareholder does not equal 25 or its multiple.

When the reverse split of LUG shares results in the creation of the so-called minority stakes, the shareholder will receive one share of the new nominal value in exchange for shares representing minority stakes, at the expense of the rights held by the Brokerage House AmerBrokers S.A. This is possible under the agreement signed by LUG S.A. and DM AmerBrokers S.A., which was announced in the relevant current report.

The number of shares to be provided by DM AmerBrokers is somewhat limited, therefore, in order to minimize the risk of failure of the reverse split procedure, all Shareholders are requested to adjust their numbers of shares in their securities accounts, to the number of 25 shares or its multiple, before the Reference Date.

RB 44/2012 - Request submitted by the Management Board to the Shareholders of the Company to adjust their numbers of shares

-

Share capital structure

The table presents a simulation of the share capital structure of LUG "before" and "after" the "reverse split of shares":

Number of shares before the reverse split

(nominal value PLN 0.01)Number of shares after the reverse split

(nominal value PLN 0.25)Seria A

108 000 000

4 320 000

Seria B

35 971 400

1 438 856

Seria C

35 992 850

1 439 714

Total

179 964 250

7 198 570

-

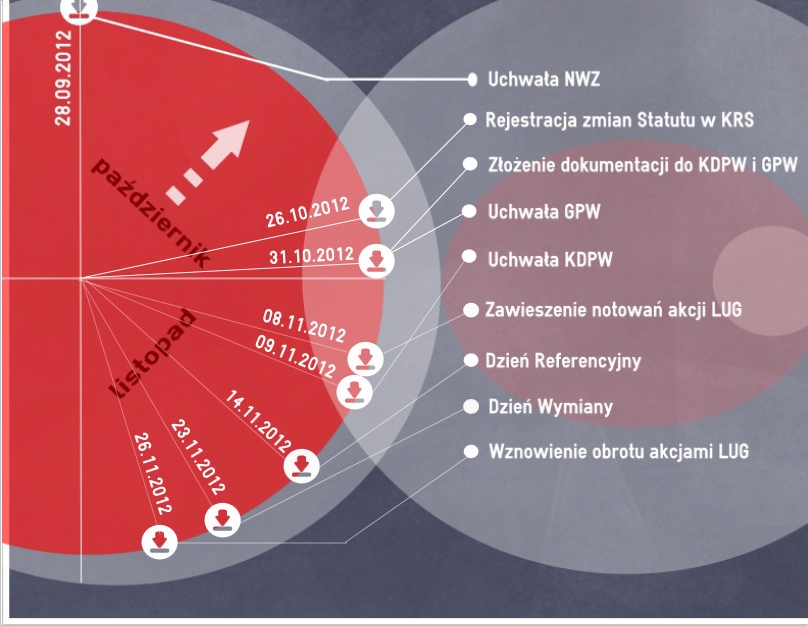

Reverse split schedule

-

FAQs

1. Will the value of my investment portfolio change as a result of the reverse split of LUG shares?

Answer: The reverse split of shares, or re-split of shares, does not create a new value of the shares. The reverse split does not diminish the value of your investment portfolio, but it does not build this value either.

Example: When you have 1,000 shares of LUG S.A. and the rate is PLN 0.15 per share, the value of your portfolio is 1,000 x PLN 0.15 = PLN 150 (their nominal value is PLN 0.01). In the case of the reverse split of shares in the ratio of 25:1, you will have 40 LUG shares at the rate of PLN 3.75 per share so the value of your portfolio will still be PLN 150. The new nominal value of a share is PLN 0.25.

2. Why does LUG implement the reverse split of shares?

Answer: The Shareholders of LUG decided to re-split shares at the Extraordinary General Meeting of LUG S.A. on 28 September 2012, based on the following reasons:

• LUG shares have a low nominal value,

• the aim of quotation of the LUG shares on the NewConnect is to ensure their accurate and reliable value, which is difficult with their current nominal value because the average price of the Company's shares over the last month has remained below PLN 0.20,

• the current situation is neither favourable to the Company, particularly for its image, nor to the interests of all Shareholders of LUG as it may be adversely reflected in the valuation of its shares;

Moreover, during numerous meetings with investors, the Management Board of LUG S.A. received signals confirming that the reverse split of shares will increase the investment potential of the Company's shares by reducing the risk of high volatility.

3. How will the reverse split of shares affect the price of LUG shares?

Short-term changes in the share price due to the reverse split are difficult to predict. The experiences of other companies that carried out the reverse split of shares in similar circumstances are different. Therefore, we will not speculate in this regard. We believe that good financial results, consistently implemented development strategy and reverse split of shares will contribute to the final increase of value for the shareholders.

4. How will the reverse split of shares affect the trading of LUG shares?

The listing of LUG shares might be suspended for a few days during the reverse split procedure. The exact date of the suspension will be adopted by resolution of the Management Board of the Warsaw Stock Exchange, of which the Company will inform in a separate current report. Listing will be resumed after the Exchange Date. Then LUG shares will be listed in the normal manner. The Opening Price will correspond to the Closing Price of the day before the suspension of listing, taking into account reverse split parameters such as twenty-five higher price. At the same time, there will be twenty-five time fewer shares in the market.

-

Related current reports

RB 39/2012 Announcement of Extraordinary General Meeting of LUG S.A. with drafts of resolutions

RB 42/2012 Resolutions approved by the Extraordinary General Meeting of LUG S.A. of 28.09.2012

RB 44/2012 Management Board request for adjustment of Shareholder's share possesion

RB 46/2012 Merger register (re-split) of shares and Company's Articles of Association changes

RB 48/2012 Designation of the Reference Day on 14 November 2012

RB 49/2012 Submission of the request for LUG S.A. shares merging to the National Depository of Securities

RB 50/2012 Submission of the request to the Warsaw Stock Exchange for the suspension of LUG S.A. shares trade

RB 51/2012 Suspension of LUG S.A. shares trade regarding to its merger

RB 53/2012 Resolution of National Depository of Securities regarding to LUG S.A. shares merger

-

Contact

If you do not find the answer to your question in our Knowledge Centre, please contact us:

e-mail: relacje@lug.com.pl