LIGHTING MARKET

The lighting industry is very diverse and complex, and its products are used in many areas of everyday life.

The target of LUG S.A. Capital Group is the general lighting segment. LUG specializes in manufacturing of lighting fixtures dedicated for commercial applications. This kind of applications is characterized by higher exploitation of products in comparison to exploitation of products used by individual customers. LUG guarantees to its partners complete service in design and supply of lighting solutions, as well as technical consultancy, carried out by complex design of lighting projects.

STRUCTURE OF THE MARKET

Lighting market consist of 3 basic segments:

- general lighting – where the LUG S.A. group operates

- backlighting – lighting that is in use e.g. in LCD technology

- automotive lighting – used in automotive industry

MARKET PROSPECTS

The main factors that affect the demand on the lighting market are: growth of population, urbanization and climate changes, which increase the global interest in energy efficiency and respect for the environement.

The worth of global lighting market in 2020 is estimated at approximately 100 bln euro. Revenue of the European lighting sector is 30% of global revenue in the lighting industry.

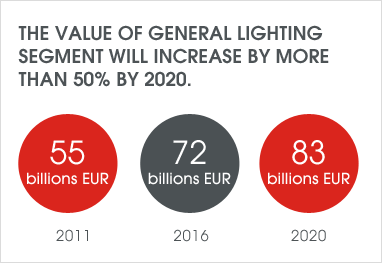

In 2011 general lighting constituted about 75% of the global lighting market. According to the forecast of McKinsey & Company, untill 2020 the share of general lighting in the lighting market will increase up to 80%. The estimated average growth in this segment is said to be 6% in 2010-2016 and 3% in 2016-2020.

INNOVATIONS

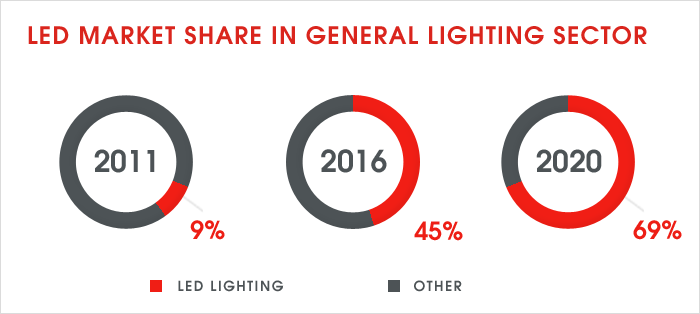

The most innovative technology on the market is semi conductor lighting (LED and OLED). LED lighting develops the most dynamically, because it is energy efficient and meets proecological trends. It is expected to shortly become a commonly used technology in general lighting.

The value of the lighting segment in LED technology in 2020 is estimated at 57 bln euro.

On base of „Lighting the way: Perspectives on the global lighting market”, McKinsey&Company 2012r., second edition

COMPETITION ON THE MARKET

The lighting market in Poland, as well as in other markets in Central and East Europe, is characterized by high fragmentation

Except for several small national manufacturers and importers, on the market we can distinguish a group of several operators, working in professional lighting technics area. Companies within this group specialize in production of fixtures for commercial applications, incuding: outdoor illumination, retail and office lighting, industrial lighting, illumination of sport facilities and street lighting. This segment is the target of LUG S.A., in this group you will find only professional manufacturers operating internationally.

On the Polish market you can find several important manufacturers with a strong position and wide assortment ( including LUG S.A.Capital Group) and a couple of foreign manufacturers.

Except for professional lighting manufacturers, Polish companies also compete with foreign suppliers of cheap, low quality lighting solutions, mainly from Central and East Europe, and Asia (mostly China)

Leading polish companies from the lighting market present at the Polish Stock Exchange

Lighting industry is a mature segment with a stabile demand. Main distribution chanels are:

- indirect sales for specialist electrotechnical wholesalers

- direct sales for architectonic investments

MARKET OUTLOOK

Factors that will positively stimulate the lighting market development in the next years:

Irreversible climate change – change of climate and scarcity of resources, including limited electricity resources causes energy efficient products dissemination to be a global trend today, what leads to choosing more expensive, energy effective lighting. It is very important that compared with other methods of CO2 emission reduction, exchange of lighting for energy efficient ones doesn’t have a negative impact on global economy. It stimulates it positively. The goal that was pointed in EUROPE 2020 strategy, is based on increasing of energy efficiency of 20% till 2020. Today lighting in Europe consumes 14% of total lighting consumption.

Renovation of eldering buildings and installations – Approximately 75% of lighting installation in Europe is older than 25 years, what will additionally stimulate the process of common exchange of lighting for energy efficient.

Development of infrastructure investments in developing countries and higher penetration of market by technologies based on more expensive light sources, including LEDs stimulates the general lighting segment.

Fast growth of population , especially in developing countries, simultaneously with growth of income. In 2020 the population is expected to grow up to 7,7 bln. Higher incomes in developed countries determines demand for lighting products, especially products with high aestetic qualities, that are simultaneously energy efficient.

Urbanization . Forecasts show that economy will globally grow by 3-4% in 2010-2020. The highest increase (app.6)% of global GDP) will be stmulated by cities, that will build demand in the general lighting segment. In urbanized areas the demand for lighting is much higer that in rural regions. Except for Asia, the highest urbanization will be possible to notice in South America, North Africa and Sub-Saharan Africa.

OUTLETS OF LUG S.A. CAPITAL GROUP

LUG S.A. Capital Group sales its products all over the world.

The most important direction of export are European countries. In 2013 the share of revenues from sales to these countries in global sales was 66%. L uminaires by LUG are available in 56 countries worldwide.