LUG - the best investment of the winning fund Novo Akcje

06 November 2017

LUG - Luminaires manufacturer from Zielona Góra, listed on alternative market NewConnect was awarded in the ranking of StockWatch.pl, supporting a wide range of individual investors, among others by providing up-to-date and verified financial data for companies.

LUG proved to be the best investment of the Novo Akcje fund, which regarding to the data published at the end of September, is the unqualified winner of the 2017 investment fund rating.

As reported by StockWatch experts, from this year's boom on the WSE has benefited only few investment funds. Only a few are able to beat the market and reach a higher return than the WIG (+24.2%). The best of them reached nearly 40% rate of return at the end of September. StockWatch analysts have looked at stocks that have drawn up portfolios of the three strongest funds.

"In our comparison we included investments with at least 2% of funds measures. While analyzing the portfolios of funds, be aware of the limits they are subject to. Basic is the maximum investment limit for a single company. Depending on the statutory provisions for open investment funds it amounts to 5 or 10 percent. Funds disclose their holdings only semi-annually, plus a 3-month delay. In the case of the analysis of the fund portfolios presented below, you can only speculate whether the shares disclosed in the portfolio at the end of the first half of 2017 are still in their possession." - we read in the article.

The best in the StockWatch ranking was the Novo Akcje fund with 38.6 percent, surpassing the main index of the Warsaw Stock Exchange by over 14 ppts. within 9 months. The fact is that in this period, only half of the analyzed funds reached a return rate higher than 16% (median).

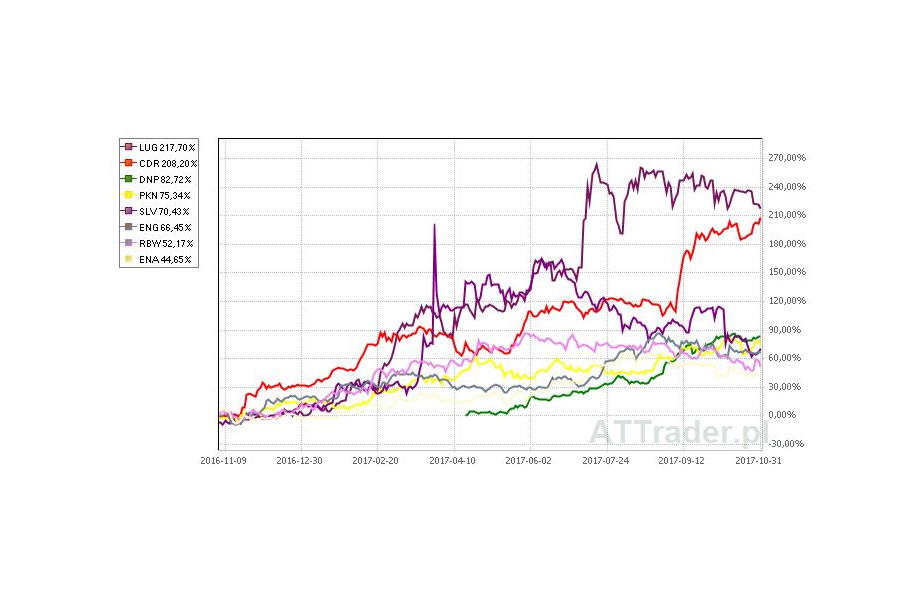

By far the best investment of the Novo Shares fund was LUG - the only company in this ranking listed on NewConnect market. As we read in the article, Novo Shares improved its position from 230 thousand shares in early 2017 to 250 thousand at the end of June. At that time LUG's quotations increased by 145%, and the upward trend itself was also followed by 3Q, which made this year's return over than 200%.

StockWatch's article highlights the dynamic improvement of LUG's financial performance and the focus of its operations on foreign expansion, as evidenced by the construction of a factory in Argentina. Taking into account the company's intention to move to the main WSE parquet and further improve its performance, StockWatch also sees a chance to continue further growth. The specialists also mentioned the announcement of the new LUG strategy in June 2017, which caused discussion among the forum members about the meaning and opportunities for its implementation.

Apart from LUG, the next two investments of Novo Akcje are energy companies - Enea (+58.5% from the beginning of the year) and Energa (+49.4%). The Credit Agricole Equity Fund (managed by BZ WBK TFI) and Skarbiec Akcja share with 23.9%.

As StockWatch experts point out, unreflective copying of best-of-breed strategies is not a guarantee of success, because as well for them it is usually a challenge to repeat such good results in subsequent years. The situation appears to be quite modeled and may announce problems with the continuation of the boom: "Usually the rise at the beginning concern the biggest companies, and then the interest of investors moves to smaller values. Such a scenario would require looking for favorites for 2018 among the smaller companies that have healthy foundations and fast-growing business." - we read in the article.

READ THE ARTICLE ON STOCKWATCH.PL